As part of the 2016 Budget, the UK Chancellor announced changes to the way UK businesses report and pay tax on their energy use.

Currently some UK companies must comply with multiple energy reporting and taxation schemes. These include the Climate Change Levy (CCL), Carbon Reduction Commitment (CRC) & Energy Savings Opportunity Scheme (ESOS) as well as the mandatory reporting of greenhouse gas (GHG) emissions for all quoted companies.

Within the 2016 Budget it was confirmed that the CRC scheme will close at the end of the 2018-19 compliance year. Businesses will be required to surrender CO2 allowances for the final time in October 2019.

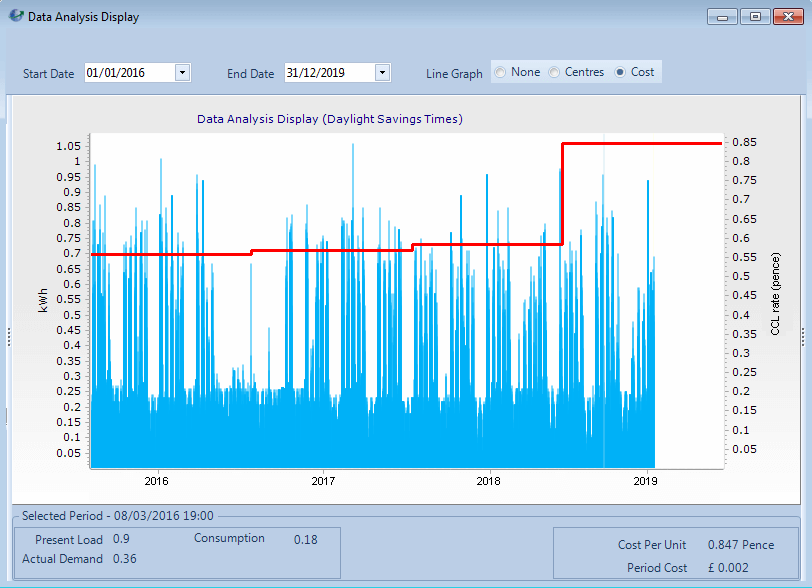

In order to recoup the revenue lost from the closure of the CRC scheme, Climate Change Levy rates will increase from April 2019. The proposed new rates are as follows:

Climate Change Levy main rates

| Taxable commodity | Rate from 1 April 2016 | Rate from 1 April 2017 | Rate from 1 April 2018 | Rate from 1 April 2019 |

| Electricity (£ per kilowatt hour (KWh)) | 0.00559 | 0.00568 | 0.00583 | 0.00847 |

| Natural gas (£ per KWh) | 0.00195 | 0.00198 | 0.00203 | 0.00339 |

| LPG (£ per kilogram (kg)) | 0.01251 | 0.01272 | 0.01304 | 0.02175 |

| Any other taxable commodity (£ per kg) | 0.01526 | 0.01551 | 0.01591 | 0.02653 |

(Source: Climate Change Levy Policy Paper 16 Mar 2016)

Climate Change Levy Main Rates to 2019 – Budget 2016

The Climate Change Agreement (CCA) scheme will remain in place with the existing eligibility criteria until at least 2023. This scheme provides a significant discount to the CCL rates to participating energy intensive businesses who meet agreed energy efficiency or carbon reduction targets.

From April 2019 the reductions obtained through the CCA scheme will rise to offset the Climate Change Levy Increases, ensuring that no CCA participants will pay more in CCL than would be expected with the normal (currently expected) Retail Prices Index (RPI) increase for that year.

The reduced Climate Change Levy rates paid by members of the CCA scheme will be as follows:

Climate Change Levy reduced rates

| Taxable commodity | Rate from 1 April 2016 | Rate from 1 April 2017 | Rate from 1 April 2018 | Rate from 1 April 2019 |

| Electricity | 10% | 10% | 10% | 7% |

| Natural gas | 35% | 35% | 35% | 22% |

| LPG | 35% | 35% | 35% | 22% |

| Any other taxable commodity | 35% | 35% | 35% | 22% |

(Source: Climate Change Levy Policy Paper 16 Mar 2016)

Installation of an AtlasEMS Energy Management system can help reduce the impact of the Climate Change Levy and provide evidence of your efforts to reduce energy use for the Climate Change Agreement scheme.

For more information on the changes to the Climate Change Levy announced in Budget 2016 please see the government’s policy paper at:

https://www.gov.uk/govern…/climate-change-levy-main-and-reduced-rates